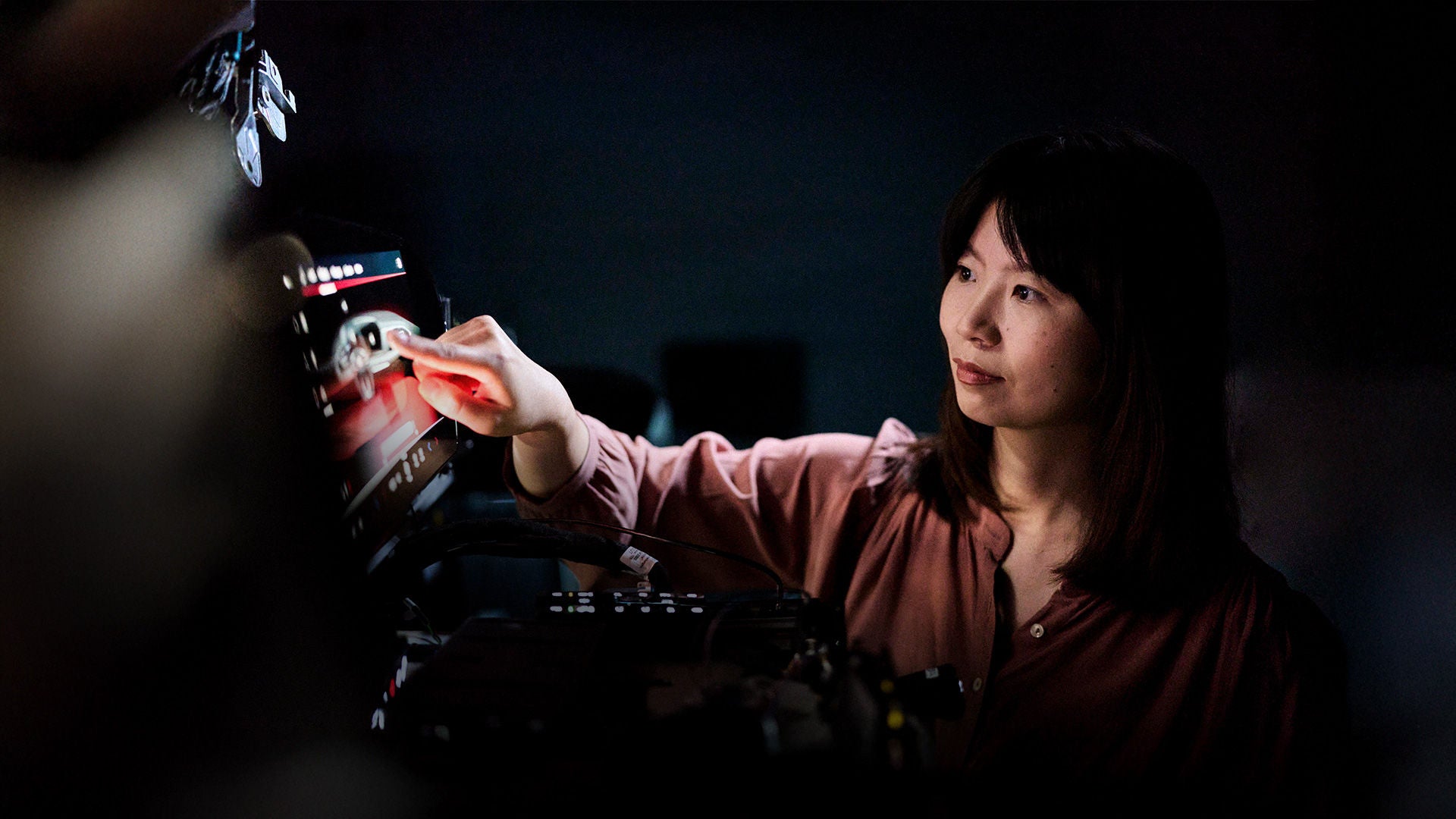

Audi makes maintenance smart:

Stress-free driving thanks to smart early detection

Audi Q6 Sportback e-tron: Power consumption (combined): 18.4–15.1 kWh/100km; CO₂ emissions (combined): 0 g/km; CO₂ class: A

Current topics from the world of Audi

Formula 1®

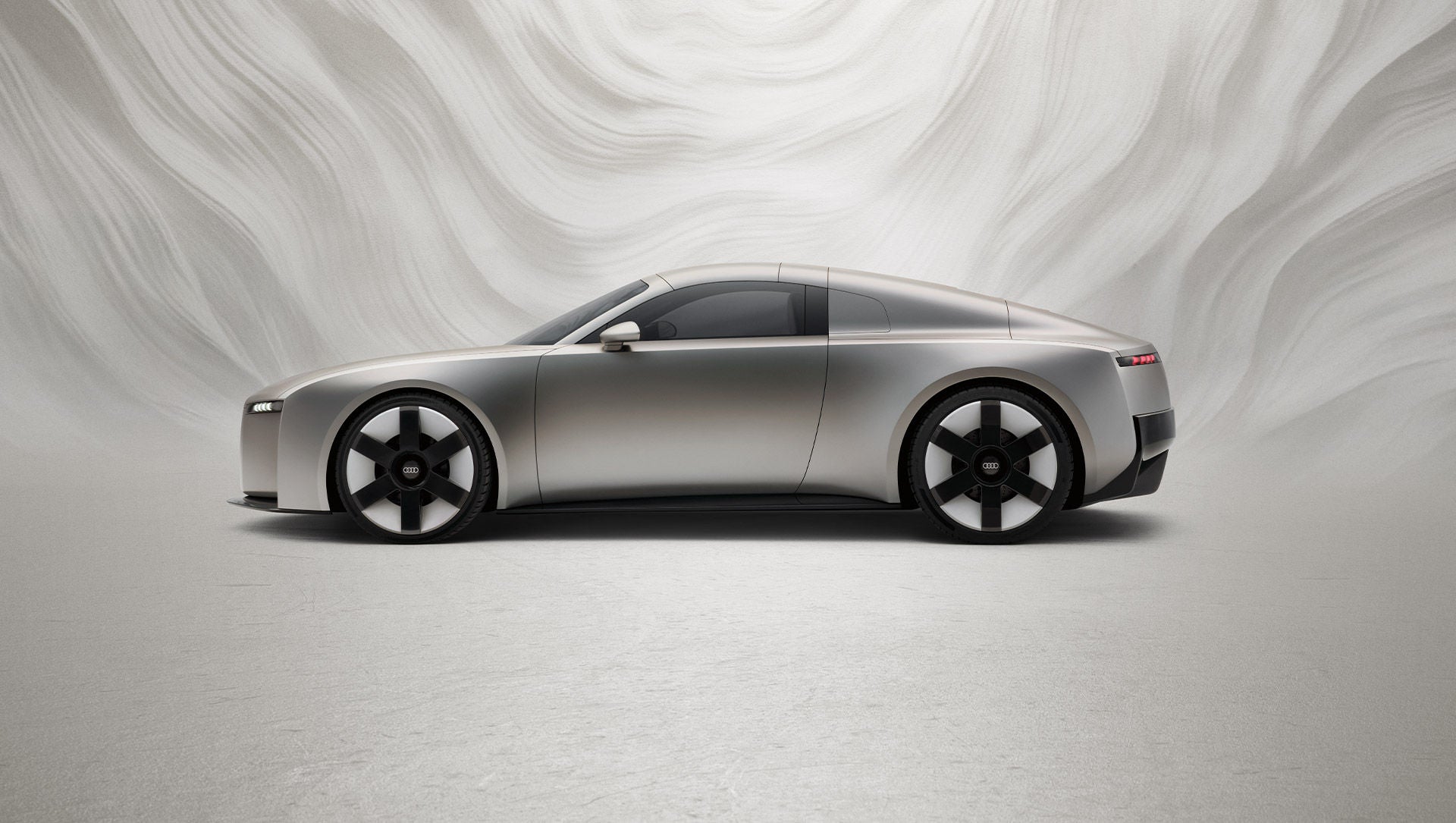

Audi will compete in the premier class of motorsport in 2026

(1).jpg)