Financial highlights and outlook

Downloads: Quick access to the figures

Review of key figures and outlook

The Brand Group Premium closed the 2022 fiscal year with a record result in a year when the company continued on its path toward becoming a leading provider of connected, fully electric premium mobility. Jürgen Rittersberger, Board Member for Finance, Legal Affairs and IT, puts the key figures into context.

“2022 clearly demonstrated: Our brand group is robust and profitable!”

Brand Group Progressive 2022 – key figures at a glance

Brand Group Progressive 2022

2022 fiscal year

Deliveries

1.6

Mio.

Revenue

EUR

61.8

billion

Return on Investment

22.2

percent

Operating profit

EUR

7.6

billion

Operating return on sales

12.2

percent

Net cash flow

EUR

4.8

billion

Outlook: Fiscal year 2023

Anticipated development in the key performance indicators of the Brand Group Progressive

Audi, Bentley, Lamborghini und Ducati

| Actual 2022 | Forecast 2023 | Strategic goals | |

|---|---|---|---|

| Anticipated development in the key performance indicators of the Brand Group Progressive1 |

1.6 million vehicles |

between 1.8 and 1.9 million vehicles

|

|

| Revenue |

EUR 61.8 billion |

between EUR 69 and 72 billion |

|

|

Operating return on sales (ROS) |

12.2 % |

between 9 and 11% |

2030: > 11% Until then: 9–11% |

|

Return on investment (ROI) |

22.2 % |

between 19 and 22% |

> 21 % |

|

Net cash flow |

EUR 4.8 billion |

between EUR 4.5 and 5.5 billion |

|

|

Research and development ratio |

7.3 % |

within the strategic target corridor of 6 to 7 percent |

between 6-7 % |

|

Capex Ratio |

4.2 %

|

within the strategic target corridor of 4 to 5 percent |

between 4-5 % |

Successful crisis management: How the of the Brand Group Progressive mastered diverse challenges in 2022

The 2022 fiscal year was characterized by multiple crises and disruptions in the global value chain. The Brand Group Progressive countered these with comprehensive crisis management.

The year 2021 was already significantly affected by problems in the supply of semiconductors, among other reasons due to regional Covid lockdowns and natural disasters. Business operations and key figures of the Progressive brand group were significantly impacted in the year under review by numerous other crises and the convergence of negative external influences, albeit some temporary in nature. The Progressive brand group was faced with major challenges in 2022 in a year that was defined by the Russia-Ukraine war, fragile supply chains, ongoing restrictions in the supply of semiconductors, lockdowns in China due to the pandemic, threats of energy shortages and high energy prices, to say nothing of high inflation and fears of recession.

Supplies of semiconductors were therefore restricted throughout all of 2022, impacting planned vehicle production and consequently deliveries. The structural undersupply of semiconductors is likely to continue to be felt in 2023, even though there has been some gradual improvement in the supply of parts since the second half of 2022. There were also further restrictions in supply, in relation to batteries for plug-in hybrid and fully electric models, for example.

Crisis teams established as early as 2020 worked at great pace in consultation with the Volkswagen Group in order to minimize the impact. The Progressive brand group collaborated very closely in this respect with its suppliers and in part also with the manufacturers of semiconductors. Group Procurement was also in constant contact with chip brokers in order to further increase supply security. Other key measures included ongoing adaptations in production to take account of installation rates, equipment variants and profit contributions within the Progressive brand group as well as the development of technical alternatives and alternative solutions. Furthermore, the Audi brand in particular worked closely with customers to find the best possible alternatives, while partially limiting the range of models and options offered at the same time.

Good price enforcement and reductions in sales incentives in the face of strong market demand had a positive impact on the operating profit of the Progressive brand group.

Logistics and supply chain affected worldwide

Production and deliveries in China came under strain at times owing to local lockdowns as part of the zero-Covid strategy imposed by the government up until the end of 2022. This caused disruptions in the logistics chains as well as temporary closures of production sites and dealerships. Outside of China also, the Progressive brand group had to face a number of logistics constraints, primarily in the area of truck freight due to a lack of drivers as well as in rail traffic and sea freight.

The war in Ukraine and the resulting sanctions imposed on Russia also had a negative impact from an economic perspective. For example, the Progressive brand group ceased all vehicle deliveries to Russia. In addition, the supply of cable harnesses and other components from Ukrainian suppliers was also restricted at times. The Progressive brand group remained generally faithful to the experienced and highly competent supplier network in Ukraine and therefore maintained the supplier relationships as far as possible. In parallel, Audi established suitable duplication sites as part of its efforts to safeguard against geopolitical risks, which can be used in the event of disruptions or further escalation of the war in Ukraine. The Progressive brand group was therefore able to mitigate the effects for the most part and make up for the temporary production adjustments in most cases.

Volatile prices for commodities and energy

The, in some cases, very sharp rise in commodity prices as a result of the war had a very positive effect on operating profit in the first quarter of 2022 in particular, owing to the valuation effects of existing hedging transactions, though this was pared back significantly from the second quarter. However, commodity prices remained highly volatile in the further course of the year. Furthermore, energy prices increased sharply in the year under review, primarily due to the threat of shortages. The effects were successfully constrained thanks to a partial switch from gas to oil as an energy source and the stockpiling of oil to stave off a possible shortage, as well as to intensive energy saving measures in the plants.

A further challenge was posed by inflation, which started to increase rapidly mid-way through 2022, especially in the eurozone and the USA. This led to interest rate rises on the capital markets and a significant decline in growth predictions or even fears of recession in the affected regions, which is expected to have an impact on the 2023 fiscal year. Currency markets fluctuated sharply in this context, too. Furthermore, the slowdown in growth in the Chinese economy had a negative impact on the global economic outlook. Increasingly protectionist tendencies such as in the USA, for example, as well as trade restrictions and other geopolitical tensions did not yet have any financial impact on the 2022 fiscal year, however. The Brand Group Progressive monitors these risks intensively within its risk management system and in the crisis teams.

In addition to the instruments described, the efficiency measures undertaken in recent years, such as the Audi. Zukunft initiative, the Audi transformation plan and other fixed-cost programs of the brands, have resulted in a much more resilient positioning of the Brand Group Progressive. It was possible to reduce fixed costs significantly and, among other things, the break-even point is being reached a lot earlier than in the past. This was also one of the reasons why the Brand Group Progressive recorded such an exceptionally good fiscal year from a financial perspective, despite significant challenges.

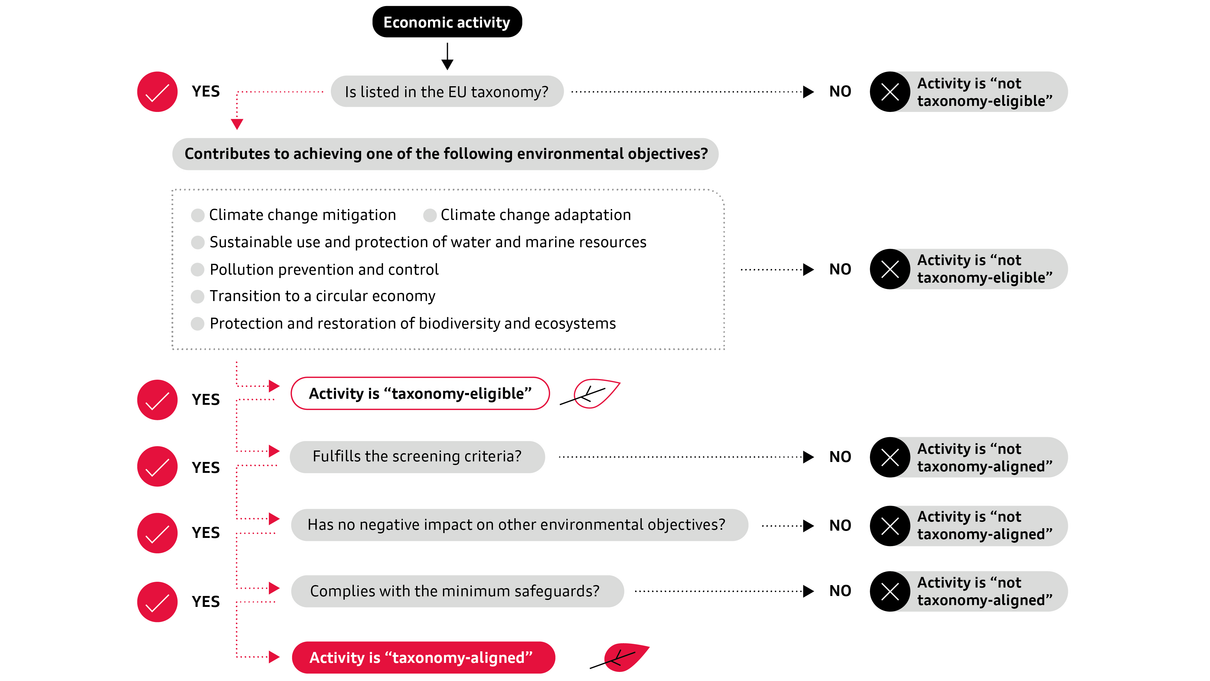

EU taxonomy

The EU taxonomy makes sustainable business operations measurable and comparable. Audi makes voluntary disclosures in accordance with the EU Taxonomy Regulation.

The European Union (EU) is increasing its focus on climate change mitigation. The “European Green Deal” and the goal of becoming climate-neutral by 2050 are an expression of the EU’s great ambition and provide the framework for a broad package of measures. The EU taxonomy represents the logical step on this path and, at the same time, is one of the central measures in the aforementioned package. Its goal is to redirect capital to sustainable investments while fostering transparency and the long term in financial and economic activity. To this end, the EU Taxonomy Regulation and the associated delegating acts define criteria to make companies’ sustainable business operations uniformly measurable and comparable. At the same time, the EU taxonomy goes beyond the climate change mitigation aspect to require additional compliance with social aspects, for example.

The Volkswagen Group is committed to the Paris Climate Agreement and aligns its activities with the 1.5-degree goal. It intends to become a net carbon-neutral enterprise by 2050.

Voluntary reporting by the Brand Group Progressive

The Brand Group Progressive is a fully consolidated Volkswagen Group company and is therefore not required to provide a separate report in accordance with EU taxonomy criteria. Since fiscal year 2021, the Progressive brand group is fostering transparency by publishing a voluntary report of the key figures relating to the EU taxonomy, thus reflecting the priority the brands give to ESG (Environmental, Social & Governance) criteria. Sustainability has a central role for the Brand Group Progressive and this is to be demonstrated visibly.

- Manufacture of low-carbon technologies for transport

- Contribution to the environmental goal of climate change mitigation

The Brand Group Progressive’s business model covers the development, production and selling of vehicles and the associated activities. Within the meaning of the EU Taxonomy Regulation, activities in these areas are suited to making a substantial contribution to the environmental goal of climate change mitigation through the expansion of clean or climate-neutral mobility.

As part of the environmental objective of climate change mitigation, the Brand Group Progressive assigns all the activities listed to the economic activity “Manufacture of low-carbon technologies for transport.” This applies to all cars and motorcycles produced, irrespective of their drive technology, and also includes genuine parts.

In the Brand Group Progressive’s current estimation, hedging transactions and individual activities of subordinate importance, which are reported as other sales revenue in Audi’s consolidated financial statements, should not be assigned to an economic activity and are therefore not deemed in the first instance to be taxonomy-eligible.

Other activities which are directly connected with the aforementioned vehicle-related business and, in Audi’s estimation, should also be assigned to this economic activity, are currently classified as not taxonomy-eligible. On the basis of the requirements published by the EU, it was not clear which economic activity they should be assigned to in accordance with the EU taxonomy. These activities particularly include the sale of engines and powertrains, as well as parts deliveries and production under license by third parties, which are also reported as other sales revenue.

- Vehicle CO₂ emissions

- BEV = 0 g/km CO₂ and PHEV < 50 g/km CO₂ by 2025

The key performance indicator for fulfilling the screening criteria is the CO₂ emissions of the vehicles produced by the Brand Group Progressive. In our vehicle-related business, we have detailed the vehicles manufactured by us by model and powertrain technology and analyzed the CO₂ emissions associated with them in accordance with WLTP. In this way, we have identified those vehicles among all of our taxonomy-eligible vehicles that meet the screening criteria and with which the substantial contribution to climate change mitigation is measured. Until December 31, 2025, a threshold value of < 50 g/km CO₂ (WLTP) will apply.

These vehicles include the Brand Group Progressive’s fully electric vehicles (BEV):

- Audi Q4 e-tron, Audi e-tron/Audi Q8 e-tron, Audi e-tron GT

In addition, most of the plug-in hybrids (PHEV) produced by the Brand Group Progressive also fulfill the screening criteria:

- Vehicles of the model lines Audi A3, Q3, A6, A7 and most of the Audi Q5 and A8 model lines

For fulfilling the screening criteria, a CO₂ threshold of 0 g/km already applies to motorcycles. None of the motorcycles in the Ducati product range met this requirement. At the same time, development work started on fully electric motorcycles in the 2022 fiscal year.

- No significant harm to the other environmental objectives

- Central Volkswagen assessment: criteria fulfilled by Audi

Ecologically sustainable economic activities within the meaning of the EU taxonomy must not only contribute to at least one of the defined environmental objectives but may also have no negative impact on the other environmental objectives. The DNSH (Do No Significant Harm) criteria for economic activities define the minimum requirements which must be fulfilled in order to exclude any significant harm to any of the other environmental objectives.

In the year under review, the DNSH criteria for the economic activity “Manufacture of low-carbon technologies for transport” for the Brand Group Progressive were analyzed at the higher level of the Volkswagen Group. For the vehicle-related business, the analysis was performed at the level of the individual production sites which manufacture or will in the future manufacture Audi vehicles that fulfill the screening criteria named under step 2 above or will do so in the future in accordance with the five-year plan.

The Volkswagen Group’s Annual Report presents the key interpretations and analyses used by the Volkswagen Group to examine whether any substantial harm has been done to the other environmental objectives. The result of these assessments is that the Brand Group Progressive’s vehicle-producing sites fulfilled the DNSH criteria in the year under review.

- Upholding human rights and meeting minimum social standards

- Central Volkswagen assessment: criteria fulfilled by Audi

The minimum safeguards consist of the OECD Guidelines for Multinational Enterprises, the United Nations Guiding Principles on Business and Human Rights, the Fundamental Conventions of the International Labour Organization (ILO) and the International Bill of Human Rights.

The Brand Group Progressive is aware of its corporate responsibility for human rights, is committed to these conventions and declarations and affirms its acceptance of the content and principles specified therein.

The Volkswagen Group has performed and concluded human rights risk assessments for all Brand Group Progressive companies, including the sites audited in accordance with DNSH criteria. This risk analysis took account of the results and risk assessments from the previous year. For the risks identified in the analysis, the companies received risk-specific measures which had to be implemented. The Group constantly monitors the status of implementation of these measures.

The result of these assessments is that the requirements of the minimum safeguards were fulfilled in the year under review.

Audi Q8 e-tron: Power consumption (combined) in kWh/100 km: 25.3–20.1CO₂ emissions (combined) in g/km: 0CO₂ emission class: A

Audi e-tron GT: Power consumption (combined) in kWh/100 km: 21.6–19.6CO₂ emissions (combined) in g/km: 0CO₂ emission class: A

Audi Q8 e-tron: Power consumption (combined) in kWh/100 km: 25.3–20.1CO₂ emissions (combined) in g/km: 0CO₂ emission class: A

Audi e-tron GT: Power consumption (combined) in kWh/100 km: 21.6–19.6CO₂ emissions (combined) in g/km: 0CO₂ emission class: A

Revenue of the Brand Group Progressive in 2022 totaled EUR 61.8 (53.1) billion. Of this amount, EUR 51.6 (42.7) billion, or 83.5 (80.6) percent, was attributable to the economic activity “Manufacture of low-carbon technologies for transport” and therefore classified as taxonomy-eligible. This mainly includes the sales revenue from new and used vehicles, including motorcycles, from genuine parts, from extended warranties, and from the rental and lease business.

Of this amount, EUR 8.3 (6.8) billion, or 13.5 (12.8) percent, fulfilled the screening criteria (see step 2).

Because it satisfies the DNSH criteria and minimum safeguards, this proportion of sales revenue can be classified as taxonomy-aligned. In the case of fully electric models only, this applied to EUR 6.1 (4.1) billion or 9.8 (7.7) percent of Brand Group Progressive revenue. By contrast, revenue from the sale of PHEVs was down on the previous year because of supply problems.

Capital expenditure

In accordance with the EU taxonomy, capital expenditure covers additions to intangible assets, property, plant and equipment, leasing and rental assets, and investment property.

All capital expenditure attributable to the vehicle-related business was associated with the economic activity “Manufacture of low-carbon technologies for transport.” No substantial capital expenditure was assigned to the other activities in the vehicle-related business (especially engines, powertrains, parts deliveries and franchises) deliveries) that were initially not included.

In fiscal year 2022, additions in the Brand Group Progressive amounted to

- EUR 2.3 (2.1) billion from intangible assets

- EUR 2.7 (1.9) billion from property, plant and equipment

- EUR 0.1 (0.0) billion from leasing and rental assets, and investment property

Taxonomy-eligible capital expenditure thus totaled EUR 5.1 (4.0) billion or 100 percent.

Capital expenditure relating to vehicles that meet the screening criteria amounted to EUR 2.0 (1.6) billion. Taking into account the DNSH criteria and minimum safeguards, 39.3 (41.3) percent of total capital expenditure was taxonomy-aligned in 2022. The percentage decrease was largely due to life cycle-related fluctuations in capitalizable development costs for BEVs. Taxonomy-aligned capital expenditure included EUR 1.7 (1.3)

Operating expenditure

In accordance with the EU taxonomy, operating expenditure covers non-capitalized research and development costs, expenditure for maintenance and repair, and short-term leases.

All operating expenditure attributable to the vehicle-related business is associated with the economic activity “Manufacture of low-carbon technologies for transport” and was therefore classified as taxonomy-eligible.

Thus, of the Brand Group Progressive’s total operating expenditure:

- taxonomy-eligible operating expenditure: EUR 2.8 (2.5) billion or 100 (100) percent

- taxonomy-aligned operating expenditure: EUR 1.0 (0.8) billion or 36.1 (33.3) percent

The increase in taxonomy-aligned operating expenditure – both absolute and proportionate – is attributable to the growing number of environmentally sustainable projects in accordance with the EU taxonomy. In the case of fully electric vehicles, a total of EUR 0.9 (0.7) billion, or 32.8 (26.4) percent, is included in the taxonomy-aligned operating expenditure.

Progress with e-roadmap and other sustainability topics

The Brand Group Progressive is continuing with its ambitious BEV roadmap. This is reflected, among other things, in the taxonomy-aligned share of revenue of 13.5 percent as well as in the capital expenditure planned for electric mobility and digitalization. Investment in the amount of around EUR 28 billion is earmarked for these future-oriented topics through 2027.

For example, the Bentley and Lamborghini brands are committed to the electrification of their fleet, while Ducati is the exclusive supplier for the electric class of the MotoGP™ World Championship. The Audi brand recently launched the models of the Audi Q8 e-tron3 family. In addition, starting at the end of the year, the first series-production Audi Q6 e-tron models will leave the production line. In the course of 2026, the brand will then flip the switch and will launch only electric models on the global market from this time on. At the same time, Audi will expands its electric range in the next five years. By 2027, the Four Rings wants to offer an all-electric vehicle in its portfolio in all core segments. Then, according to current product planning, the company will have more than 20 electric models in its range.

The measures: noticeable changes

The Brand Group Progressive is not only transforming its product range to electric vehicles, but it is also becoming sustainable and future-proof in many other areas.

One particular focus is on production. Audi is preparing all of its own sites for the production of electric cars, with 2029 as the scheduled finish. By then, all Audi plants will produce at least one fully electric vehicle. This is already the case at the plants in Brussels and at Böllinger Höfe Neckarsulm today, and Ingolstadt is set to follow from the end of 2023.

Additionally, the company is improving the ecological footprint of its production sites with the Mission:Zero program. A critical building block on the path to becoming a more sustainable company is the reduction of CO₂ emissions along the entire automotive value chain. Audi uses the decarbonization index (DCI4) to make its progress visible. The company is also blazing new trails with regard to the circular economy and installs vehicle components that today are already partially made from secondary materials.

The Brand Group Progressive is convinced that a sustainable business model is also measured by consideration of environmental criteria, by the assumption of social responsibility and by sound corporate governance. Audi also fosters this philosophy among its partner companies. Since 2019, a positive sustainability rating (S-Rating) has been a prerequisite for awarding contracts to suppliers.

ESG is also anchored in the Audi “Vorsprung 2030” strategy. Increasingly, ESG criteria will be considered in corporate and product decisions and management remuneration. For example, since 2022, taxonomy-aligned sales revenue has ranked alongside the DCI as one of Audi’s ESG management targets.

Multi-year comparison of key performance indicators

| 2020 | 2021 | 2022 | |

|---|---|---|---|

| Deliveries to customers of the Brand Group Progressive2 (cars) | 1,700,258 | 1,688,978 | 1,638,638 |

| Revenue (EUR million) | 49,973 | 53,068 | 61,753 |

| Operating profit5 (EUR million) | 2,569 | 5,498 | 7,550 |

| Return on sales5 (ROS) (percent) | 5.5 | 10.4 | 12.2 |

| Return on investment5 (ROI) (percent) |

7.4 [²] |

16.7 [²] |

22.2 [²] |

| Net cash flow (EUR million) | 4,589 | 7,757 | 4,808 |

| Research and development ratio (percent) | 7.3 | 7.4 | 7.3 |

| Capex ratio6 (percent) | 3.8 | 3.8 | 4.2 |

Key performance indicators of the Brand Group Progressive in a nutshell

The non-financial indicator of deliveries to customers reflects the number of new vehicles of the Audi brand handed over to customers. This performance indicator reflects demand from customers for our products and reveals our competitive and image position in the various markets worldwide. Strong demand for our products has a major impact on production, and consequently also on the capacity utilization of our sites and the deployment of our workforce. In addition, a continuing high level of vehicle deliveries reflects high customer satisfaction.

The financial key performance indicators include Brand Group Progressive revenue, which is a financial reflection of our market success.

Another key performance indicator is the operating profit of the Brand Group Progressive. This key figure represents the economic performance of our core business as well as the economic performance of our fundamental operational activity, and is defined as follows:

Revenue

– Cost of goods sold

– Distribution costs

– Administrative expenses

+ Other operating income

– Other operating expenses

= Operating profit

Our financial key performance indicators also include the operating return on sales of the Progressive Brand Group:

Operating return on sales = Operating profit / Revenue

A further key performance indicator is return on investment (ROI). This reflects how effective our business activities are, by considering the return achieved on the capital employed over a given period. Return on investment already takes account of CO₂ compliance measures and can therefore also be understood as return on investment after CO₂.

Return on investment (ROI) = Operating profit after tax / Average invested assets

Net cash flow, which serves as a benchmark of the Brand Group Progressive’s level of self-financing, is calculated as follows:

Cash flow from operating activities

– Investing activities attributable to operating activities

= Net cash flow

The Research and development ratio expresses Audi’s innovative strength and also ensures that it maintains competitive cost structures.

Research and development ratio = Research and development activities / Revenue

The capex ratio is another indicator of the Brand Group Progressive’s competitiveness.

Capex ratio = Capex according to the cash flow statement / Revenue

Capex includes investments in property, plant and equipment, investment property and other intangible assets according to the cash flow statement. Here, capital investment in essence comprises financial resources for modernizing and expanding our range of products and services, for optimizing our capacities and for improving the Progressive Brand Group’s production processes. Investment decisions are requested by the specialist areas, then scrutinized and prioritized by Investment Controlling and the “Investment Group” corporate committee. Major decisions affecting investment policy are also approved by the Company’s Supervisory Board.